What do you want to know?

Why take out death insurance?

The death insurance contract is a contingency contract which allows the payment of a capital or an annuity to a designated beneficiary in the event of the death of the insured. This contract can be for a fixed term (temporary death) or indefinite (whole life contract).

The individual death insurance contract is useful to protect his family in the event of financial difficulties related to his disappearance.

Death cover can be only accidental or all causes, that is to say in the event of accident, but also of illness.

The individual death insurance contract may provide for the payment of a capital or an annuity (education annuity and / or surviving spouse's annuity).

The contract can also offer a total and irreversible loss of autonomy guarantee (PTIA), which allows the insured to protect himself against the risk of absolute and permanent incapacity to work.

Provident contract: death insurance

What is a death insurance contract?

Insurance in the event of death is a life insurance contract which allows the payment of a capital or an annuity to a designated beneficiary, in the event of the death of the insured before the end of the contract.

These life insurance contracts can be taken out individually or collectively, through a company or an association. They can be taken out on the occasion of a loan.

Death insurance contracts can be taken out either for a limited period (term death insurance) or for the entire life (whole life insurance).

Death cover can be only accidental or all causes, that is to say in the event of accident, but also of illness. The individual death insurance contract may provide for the payment of a capital or an annuity (education annuity and / or surviving spouse's annuity).

Insurance in the event of death may be accompanied by additional guarantees (guarantee against the risks of incapacity or invalidity, increase in the guarantee in the event of accidental death, etc.).

Different formulas therefore make it possible to build up capital or an annuity to overcome the financial difficulties that may arise due to the disappearance of a person.

Death insurance contracts can be taken out:

Or for a limited period (term insurance): they then allow the survivor to ensure the standard of living of the family. The insurance can also ensure the payment of an annuity intended to finance the studies of the children.

Or for the whole life ("whole life" insurance): The "whole life" death insurance contract can be taken out on 2 heads, which allows the payment to one of the spouses of the capital or the annuity on the death of her husband.

Opening of the contract

Opening of the contract

Death insurance provides, against contributions, the payment of a capital to the beneficiaries of your choice in the event of death.

An essential foresight act to financially protect your family. Provided that the terms of the contract correspond to your needs and your situation.

Death insurance therefore allows you to leave a capital to your loved ones after your death (children, spouse, friend) so that they are free to use this capital as they see fit.

In this, death insurance differs from a funeral insurance , the capital of which must necessarily be used to finance your funeral costs.

If you take out this type of insurance too late, your contributions will be significant. To cover an attractive capital and not to pay excessively high premiums, it is necessary to subscribe young and therefore for a long time. Moreover, most contracts cannot be taken out after a certain age: generally 70 years.

Life insurance support

Unlike life insurance, a life insurance contract is not a financial investment.

It is sunken and temporary (often 10, 15, 20 or 25 years, depending on the age of subscription).

Indeed, if the risk does not materialize - your death or for certain contracts, your complete disability - before a certain age: 65 years, 75 years, sometimes 80 years - all your contributions will be lost.

To avoid losing money, it is possible to opt for a "whole life" death guarantee. In the event of the subscriber's death (regardless of the date), the premiums paid, plus interest, will be recovered by the beneficiary of the contract.

Savings availability

In terms of life insurance, of which death insurance is a form based on provident insurance, it is sometimes possible for the subscriber to recover the death benefit planned through a buyout. The recovery of funds can be done for a part only, one speaks then of partial redemption, or for the entirety of the planned sums: total redemption.

Death insurance is based on the principle that the subscriber contributes so that in the event of premature death, his beneficiaries receive a capital to compensate for the financial problems linked to the claim.

Consequently, the purchase of a death insurance is similar to a withdrawal of the funds available since the beginning of the agreement defined with the insurer.

It is advisable to know at the time of subscription if the repurchase of the death insurance is possible, under penalty of not being able to recover the guaranteed capital before its term.

When surrender is possible, the contract contains a surrender value table, which determines the conditions for the withdrawal. Sometimes the latter is free after a certain number of years of contribution or a certain amount.

Taxation of death insurance

Upon the death of the insured, the designated beneficiaries receive a death benefit or an annuity.

These sums are considered as a benefit paid by the insurer, and not as an inheritance received from the patrimony of the deceased.

The death benefit is therefore not part of the estate. And it is not taxed as such

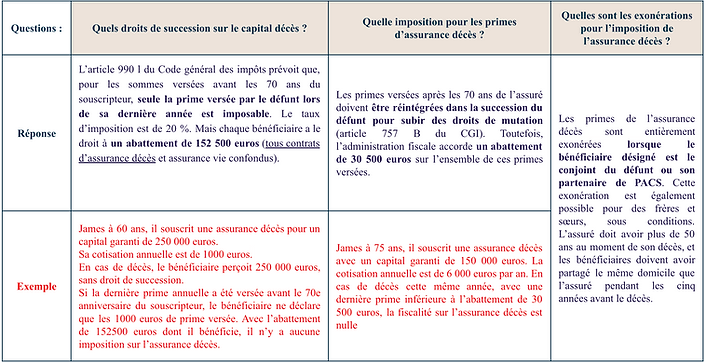

Article 990 l of the General Tax Code provides that, for amounts paid before the subscriber's 70th birthday, only the premium paid by the deceased during his last year is taxable. The tax rate is 20%. But each beneficiary is entitled to an allowance of 152,500 euros.

Premiums paid after the insured's 70th birthday must be reintegrated into the deceased's estate in order to undergo transfer taxes (article 757 B of the CGI). However, the tax administration grants an allowance of 30,500 euros on all of these premiums. paid.

Additional guarantees

It is possible to supplement your insurance contract with other guarantees, which are not always linked to the duration of the life, but cover a particular risk, for example:

Work incapacity guarantee: during a prolonged work stoppage, a daily allowance is paid to the insured. During this period, the insured may be exempted from the payment of contributions relating to the contract while benefiting from the maintenance of guarantees.

Disability guarantee: following a disability defined in the contract, the insurer pays benefits in the form of a lump sum or an annuity. When disability occurs, the insured is exempt from paying contributions relating to the insurance contract, while benefiting from the maintenance of guarantees.

Death by accident guarantee: the capital paid to the beneficiary (ies) can be doubled or tripled when death occurs by accident and in particular by traffic accident.

The loss of employment guarantee This guarantee is generally offered in insurance contracts linked to a loan and provides for either the postponement of the loan maturities, or the assumption of all or part of the monthly payments during the fixed period. by contract.

Term death insurance and / or whole life insurance

Term death insurance: It guarantees the payment of a capital or an annuity in the event of the death of the insured person occurring during the period of validity of the contract. If the insured is alive at the end of this period, the insurance contract ends. The contributions paid are not recovered by the subscriber of the contract, but benefit all policyholders: there is mutualisation of risks.

Whole life insurance: It is taken out for an indefinite period and is terminated when the death of the insured person occurs, whatever the date. This type of life insurance contract provides for the payment of a capital or an annuity to the designated beneficiary (ies)

In life insurance, of which death insurance is a form based on provident insurance, it is sometimes possible for the subscriber to recover the expected death benefit through a buy-back. The recovery of funds can be done for a part only, one speaks then of partial redemption, or for the entirety of the planned sums: total redemption.

Partial redemption: in this specific case, the subscriber takes back part of the funds normally provided for his beneficiaries in the event of premature death. The repurchase payment is often made through monthly contributions, which are then no longer used to constitute the capital, but to have the right to recover it. It is then a solution that should be used only in an emergency, especially if several years have passed since the subscription.

Total redemption: here, the full withdrawal of funds is final and is similar to the (paid) termination of the contract since the subscriber and his beneficiaries will no longer have any capital to claim in the event of death or disability.

If you want to redeem all of your death benefit, but are not against subscribing again later, it may be useful to leave a small amount in the account. In this way, the contract is not closed and you can continue to use it with new conditions.

The amount of the death insurance is not, in itself, part of the patrimony of the insured. The insured's inheritance only includes the patrimony in his possession on the eve of his death. The capital of the death insurance therefore escapes any deduction linked to the inheritance in the sense that the amount of this capital has never been part of the patrimony of the insured.

Nevertheless :

If the premiums were paid before the insured's 70th birthday; the last premium is taxed at the withholding tax of 20% (or 31.25% above € 700,000) after an allowance of € 152,500 per beneficiary.

The accumulation of premiums paid after the insured's 70th birthday is reintegrated into the estate after an allowance of € 30,500 and taxed according to the family ties between the deceased and the beneficiary.

Advantages & Disadvantages of death insurance

Death insurance

Example of use of the death insurance contract for spouses & partners

1

Initial situation

Victoria and Luc, aged 35 and 30 respectively, got married in June 2008, without a marriage contract.

From their union came 2 children, aged 5 and 8.

Victoria has not worked for 3 years, Luc earns a decent living and they prefer that she take care of their children. Knowing that the only common good is their main residence, they wonder what will happen if Luc were to die.

2

If nothing is done

Under the terms of article 757 of the Civil Code, in the presence of all common descendants, the spouse can choose during the succession a quarter in full ownership or the usufruct of all the property of the deceased.

Victoria will be responsible for the education of the two children alone. For this, she will have to find a job again for which the remuneration will not necessarily be sufficient.

The predecease of a young spouse is often little considered, yet the consequences (especially financial) are, in most of the time, very heavy.

3

Final situation

These death insurance contracts are provident contracts, the premiums of which are paid in excess.

Taking into account the age of the spouses and their state of health, the premiums paid will be modest since they are calculated according to the probability of occurrence of the envisaged risk and the amount of compensation paid in the event of death.

If the death occurs during the execution of the contract, the insurance company undertakes to pay a capital to the designated beneficiary.

In this case by selecting a death insurance contract, Luc and Victoria optimize the protection of the survivor by allocating a capital to him in order to obtain readily available resources. This capital will allow the spouse to meet the costs of everyday life such as the education of children and housing.

4

Death and cohabitation insurance

If Luc & Victoria had not been married, that is to say if they were cohabiting:

The death insurance contract would have allowed:

To contribute to the protection of the surviving cohabiting partner by allocating a capital to him.

To allow the payment of inheritance tax if the survivor is granted a bequest, because he would be subject to very heavy taxation on the goods received (60%).

If the cohabiting partners wish to transfer full ownership of the main residence to the survivor (and thus avoid joint ownership with the heirs who are reserved), the death insurance contract can provide the survivor with the necessary funds to acquire the undivided share.