What do you want to know?

Why take out a capitalization contract?

A capitalization contract works basically the same way as a life insurance contract.

For a natural person it allows to :

Place a sum of money

Obtain additional income;

Prepare for retirement

Promote your heritage

Transmit a specific asset during his lifetime with, if necessary, charges and conditions

For a legal person, the capitalization contract makes it possible to:

Place cash / liquidity

Develop and grow available capital within a company subject to corporate tax

Actively prepare for transmission

With the capitalization contract:

The subscriber builds up his savings at his own pace with free or scheduled payments.

The sums paid are invested in the fund in euros and / or units of account depending on the risk aversion of the subscriber.

The accumulated capital can be transformed into a life annuity, and therefore used to ensure a regular income for retirement for example.

The capitalization contract is generally used to organize and transmit the capital of a natural or legal person, in particular in the event of death, and to ensure the protection of the relatives of the insured.

The main difference between life insurance and capitalization contract is thus at the level of the tax system: in fact, the capitalization contract is transmitted while the life insurance contract is unwound.

Thus, the capitalization contract allows the heirs to collect the contract in succession while retaining its tax precedence. .

Finally, the capitalization contract can be transmitted by donation, while benefiting from tax deductions, donation which can be done in full ownership or in dismemberment with reserve of usufruct.

The capitalization contract, a strategic tool

What is a capitalization contract?

A capitalization contract is a financial savings package offered by insurance companies.

The purpose of the capitalization contract is to allow a natural or legal person to build up and boost capital under very advantageous tax conditions.

The capitalization contract is a financial product that allows you to save a sum of money. There is no deposit limit, nor a holding limit over time. Your paid savings remain fully available if needed.

A capitalization contract makes it possible to invest in diversified financial products: funds in euros, multi-media, dedicated funds using the capitalization technique: the interest provided for in the contract is not distributed each year, but capitalized until maturity of the contract.

The capitalization contract can be transmitted during his lifetime to a loved one as part of a donation. Also, unlike life insurance, this contract does not terminate upon the death of the insured.

The capitalization contract therefore does not present any inheritance advantage, unlike life insurance. But it can be the subject of a donation of the living . The capitalization contract can even be the subject of a dismembered donation. The subscriber thus transmits the bare ownership of the contract to his donees, often his children, and can retain the possibility of receiving the income generated by the contract.

Opening of the contract

A capitalization contract is a tax envelope. It is taken out with an insurance company, with the aim of ensuring the payment of a capital or an annuity at its term.

Unlike life insurance, the notion of hazard does not exist.

All natural persons, adults or minors, without age limit can take out a capitalization contract.

The capitalization contract can also be taken out by a legal person (company, association, etc.).

By opening a capitalization contract, you can pay money all at once (single payment) or whenever you want (free payment), or even on a scheduled basis, every month for example, by direct debit from your account ( scheduled payment).

Support for the capitalization contract

The capitalization contract allows to invest and manage financial products (funds in euros, units of account) under favorable tax conditions: withdrawals from these supports are taxed in the same way.

The Euro Fund: Your savings are not subject to movements in the financial markets, but the average return on Euro funds is limited and has tended to decrease for several years;

When it is invested 100% on the euro fund: we are talking about single-support contracts.

Account units: You have a varied choice of media (business sectors, geography) offering an expectation of gain greater than the return on the fund in euros, but your savings are not guaranteed, you may lose your money.

When it is invested Between euro and UC fund: they are qualified as multi-support contracts.

Savings availability

The capitalization contract allows the availability of your savings at any time in the form of redemption or advance.

If the capitalization contract is envisaged over the long term, the funds are however available at any time, occasionally (we speak of partial or total redemptions) or regularly (scheduled redemptions). It is also possible to recover savings in the form of a life annuity

The capital nevertheless remains available for the duration of the contract (with the exception of certain structured products):

In the event of a one-off cash flow requirement, the subscriber can request an advance (in return for interest) without the redemption value of his contract being reduced and without taxation. The contract continues to be valued on the same basis as before the advance,

if the subscriber needs additional income, he can make partial redemptions (free or scheduled), or even a total redemption.

Capitalization & Society

The operation consists of subscribing to a capitalization contract via a company with corporate tax in order to grow its cash flow, diversify its assets, or even manage more easily a dismemberment on the capitalization contract.

If they wish, the partners can take charge of the company's cash flow, without any taxation, through reimbursement of their partners' current accounts, if any. Otherwise, a distribution of taxable dividends is possible.

The titles of the company can be given in bare ownership to the children at a lower tax cost (when the company is in debt) while allowing the donor to keep the income, company control and contract management.

The invested capital remains available at any time on simple "redemption" request (partial or total).

Taxation of the capitalization contract

The taxation of interest in the event of redemption, or term repayment, depends on the duration of the contract and not on the date of the payments made.

Term repayment / Contract surrender before 8 years

The interest included in the repurchase is taxed (*):

the PFU (single flat-rate levy) at the rate of 12.8%;

or, on a global option, at the progressive scale of the IR.

Term repayment / Contract surrender after 8 years

The interest included in the repurchase is taxed (*), after application of an allowance of € 4,600 for a single person and € 9,200 for a couple (**:

the PFU (single flat-rate levy) at the rate of 7.5% (or 12.8% for the fraction of products attached to premiums exceeding € 150,000 (***)),

or, on a global option, at the progressive scale of the IR.

Succession & Donation

In the event of the subscriber's death, the capitalization contract is distinguished from the life insurance contract by the absence of exemption from inheritance tax.

The capitalization contract has the particularity of not being unwound on the death of its subscriber. The spouse and / or heirs of the deceased therefore replace the latter.

The heir is therefore subject to the common law of inheritance, but retains the tax precedence of the contract, and may continue to use it by keeping it, or by making withdrawals or free payments, while benefiting from the tax system. applicable depending on the opening date of the contract.

The capitalization contract may be the subject of a donation and / or dismemberment or allow the re-use of dismembered funds.

When the usufruct has expired by the death of the usufructuary, the bare owner becomes the sole holder of the capitalization contract.

Indeed, the application of the dismemberment mechanism makes it possible to combine usufruct and bare ownership free of inheritance tax. In other words, the value of the usufruct is transmitted free of charge.

During the savings phase, your life insurance contract is not taxable (excluding social security contributions). Unlike other financial investments, you are only taxable on the occasion of a withdrawal from your life insurance contract and only on the interest portion withdrawn.

Indeed, your redemption consists of a part of capital and a part of interest, which can be imposed depending on the duration of your life insurance contract and the date of your payments.

It is therefore at the time of redemption that you are taxed:

Taxation only relates to the share of interest included in the repurchase (exempt capital)

The tax rate can be relatively low. By opening a contract today, the tax rate will be 12.8% (possibly 7.5% if the contract is more than 8 years old and you have less than € 150,000 on all your contracts).

Social security contributions (rate of 17.2%) are retained each year or upon redemption, depending on the chosen medium.

Advantages & Disadvantages of the capitalization contract

Capitalization

Example of use of the capitalization contract

for a natural person

1

Initial situation

Michel is divorced, he has just sold his second home and has € 225,000.

He has 65 years old, retired and has two children. He wishes to invest this sum of money, but however he wishes that it remains available at all times, because he could need a part to complete his budget in addition to his retirement pension.

2

Subscription to the capitalization contract

He opens a capitalization contract and pays the full amount, ie € 225,000.

account. The average annual return is 4%.

James died 20 years later, without having consumed the savings from his capitalization contract.

3

Final situation

If nothing is done, upon his death, the capitalization contract will be integrated into his estate and taxed according to the scale of inheritance tax.

If Michel gives bare ownership of his capitalization contract to his 2 children, at the time of his death, no taxation will be due because the contract having already been transmitted, it will not be integrated into the estate.

The allowance for donations is 100,000 € per parent and per child, so the donation will not generate tax (and the allowance will be regenerated for the inheritance, +15 years, and can be used for the transmission of the main residence ).

Example of use

of the capitalization contract

for a legal person

1

Initial situation

Claude CEO of his SASU subject to the IS wants to invest the sum of € 200,000.

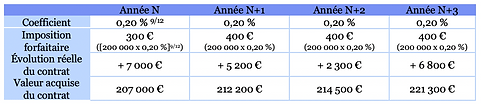

He takes out a capitalization contract for € 200,000 in March. The METR known on the day of subscription is 0.19%, ie an actuarial rate of 0.20%.

2

Mechanism of the capitalization contract

3

Final situation

For year N + 4, Michel requests a full buy-back of the contract,

The actual gain will be € 21,300 (capital gain) and the residual gain of: € 21,300 - 1,500 from flat-rate taxation) or € 19,800.