What do you want to know?

Why invest in bare leasing?

A home offered in its bare state and without furniture, is said to be rented empty or bare or unfurnished. The unfurnished rental contract is governed by the terms of the law of July 6, 1989.

The latter has undergone some modifications made by the Alur law of March 24, 2014 and by the law for growth of August 6, 2015.

Both the owner and the tenant are subject to the provisions of this law.

A bare rental is therefore real estate that is rented without any furniture or equipment other than the necessary equipment.

The only equipment provided in a bare rental are sanitary facilities, a bathroom and kitchen units (a sink for example). The term bare rental is opposed to that of furnished rental.

In empty rental, you declare your rents in the category of property income. Depending on the case, you will come under the micro-land or the real regime. With the first, you are taxed on 70% of your rents. The second allows you to create property deficits which lower your taxes.

Bare rental, a rental with many advantages

What is bare rental real estate?

Bare rental, by definition, is opposed to furnished rental. This type of investment is oriented towards empty rental, without furniture. These real estate properties attract investors: they constitute an investment with very attractive profitability and advantageous taxation.

The lease of bare accommodation, for an apartment or a house, is established according to the law of July 6, 1989.

The latter must:

be drawn up, signed and dated by the owner and the tenant;

last 3 years minimum (renewable by tacit agreement) - 6 years minimum for a legal person lessor -

It is however possible to conclude a so-called short-term lease of at least one year for family or professional reasons (cf. Article 11 of the Law of July 6, 1989).

The property must be completely empty of any furniture.

The income from this rental will be declared in the category of land income.

Note that the so-called micro-land regime is simpler. On the other hand, it is only interesting insofar as the charges that you could deduct are of an amount lower than the value of the standard allowance of 30%.

Please note: Micro-land is not possible if you invest by taking advantage of the advantages of certain tax loopholes (Besson, Robien, etc.). It is also not possible either if the rents are not collected by you directly, but by a company, such as an SCI for example.

Hold bare rental real estate

You can own the asset:

directly (in your own name), that is to say without an intermediary structure, it is part of your assets,

or through an SCI, in other words you are a partner of the company which acquires the property.

The Société Civile Immobilière (SCI) is often used in the context of family rental real estate investments, because it allows several people to own the property without the worries of joint ownership!

In addition, it optimizes the transmission of heritage to children while maintaining control.

Acquisition financing

Cash acquisition:

The real estate acquisition of a rental property thanks to a personal contribution makes it possible to immediately obtain regular income.

If the investor wants to receive income deferred over time, he can opt for the acquisition of bare ownership of a rental property. In this case, the usufruct will expire on the day the investor wishes to take advantage of the rental income.

Payment on credit:

The term of the loan will coincide with the desired date of receipt of income (deferred in time) and the loan interest will reduce taxable property income.

If the acquisition is financed with a mortgage, it is advisable to consult a credit institution or a broker to obtain financing adapted to the borrower's situation.

The loan can be:

depreciable; repayment of the capital borrowed over time

or in fine; repayment of the borrowed capital in one go at the end of the loan.

However, the loan in fine requires a contribution which will be placed on a contract in order to guarantee the repayment in the long term (= backing).

Direct detention (proper name)

Benefits of owning real estate directly :

Simplicity of acquisition,

Income tax regardless of the nature of the activity,

The capital gain is subject to the real estate capital gains regime for individuals.

Disadvantages of owning real estate live:

Few legal and tax optimization solutions,

If several buyers (joint ownership): need for everyone's agreement.

Leases and guarantees bare rental

The bare rental property can be a dwelling, but also an office, a shop, etc. The rental lease depends on the use that the tenant makes of the property.

Tenant for use as a main residence: Residential lease (Law of 6 July 1989)

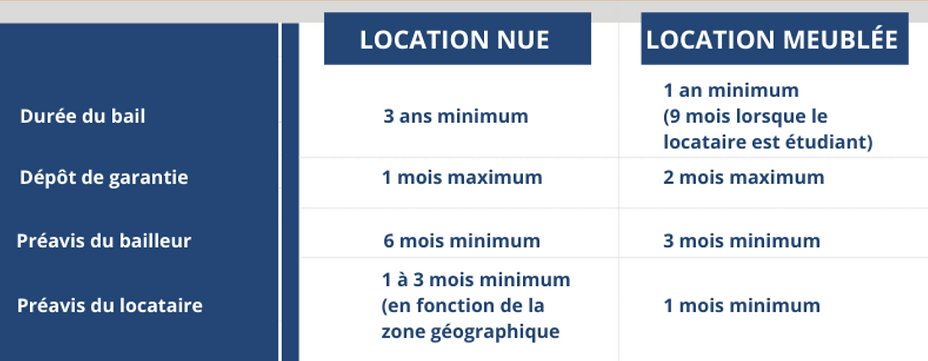

In empty rental, the lease term is three years. But it is not excluded to conclude a longer lease, of four years for example, even if this is not customary. When the lease comes to the end of the three years, it is renewed by tacit agreement for the same duration, without having to sign a new one.

Tenant for professional use: Professional lease

If the owner is a legal person (a company), the lease is obligatorily concluded for six years, unless you own the property via a family SCI (constituted between relatives and allies up to the fourth degree included), in which case the lease is three years.

Tenant has commercial use: Commercial lease

The lease contract is concluded for a minimum of 9 years. The lessor and the tenant can decide to conclude a contract for a longer period. But the contract cannot be concluded for an indefinite period. The lessor must pay an eviction indemnity to the lessee in the event of termination of the commercial lease.

You have the option of concluding a contract for a period of less than three years and at least one year if you have a family or professional reason that justifies it.

This pattern must be specified in the lease as well as the event that will end the lease (retirement, return of a child from abroad, etc.).

Finally, several mechanisms make it possible to guarantee the payment of the rent:

The deposit: In the event of default by the tenant or damage, the lessor can turn to the deposit:

simple (it can only intervene after having relaunched the tenant several times) or joint (solicited from the first unpaid)

Guarantee of unpaid rents: private insurance that the lessor can take out with a bank or an insurance company. It covers both unpaid rents and damage, but it is not free (the contribution costs between 2.5% and 5% of the annual rent).

The Visale guarantee: It is the "Action Logement" organization that acts as guarantor and it is free. It covers the entire duration of the lease within the limit of 36 months of unpaid bills. It can be used in particular when the tenant has little or no income or if he is in a precarious situation.

The housing solidarity fund: This guarantee covers people in difficulty and therefore not insurable.

Holding in SCI

Advantages of owning real estate through an SCI:

Modification of the statutes (appointment and dismissal of the manager, quorum and majority rules, approval clause),

Progressive transmission with conservation of power,

Modify the management of property between spouses,

Avoid joint ownership,

Avoid presumption of ownership.

Disadvantages of owning real estate through an SCI:

Management cost,

Keeping of accounts,

Joint and indefinite liability of the partners,

Furnished rental entails taxation at the IS.

Taxation

When you rent an apartment empty of furniture, the income must be indicated in the "property income" category of your income tax return (n ° 2042).

Two tax regimes exist for land income: the micro-land regime or the real regime.

Micro-foncier: The declaration of land income under the micro-foncier regime is reserved for investor households who receive less than € 15,000 per year in gross rents.

It provides for a flat-rate reduction of 30% on the total gross rents received to take into account all the costs related to these rental investments.

The micro-land regime does not apply in certain situations (historic monuments, housing benefiting from a special deduction regime).

The actual regime can be chosen regardless of the amount of rents received, and becomes compulsory beyond € 15,000 per year. Its main advantage is that it takes into account all the charges deductible from property income before taxation.

The charges that can be deducted from your property income are numerous. They include:

work, renovation and repair expenses

carrying out real estate diagnostics

loan interest and borrower insurance

property insurance, as well as unpaid rent insurance

condominium charges, with the exception of recoverable rental charges

property tax

If the totality of these charges exceeds 30% of the amount of the rents, it is in your interest to switch to the real regime. In some cases, very significant charges can even allow you to generate a deficit attributable to property income, but also to all of the taxpayer's income.

Note: On the other hand, construction, reconstruction or expansion work cannot be deducted from your property income.

If the investment in traditional real estate (unfurnished) does not allow the real estate part to be amortized (unlike the LMNP for example), some work is 100% deductible and chargeable up to the limit of € 10,700 per year.

Each year, you can deduct from your income up to € 10,700 of land deficit (or € 15,300 in certain special cases).

However, the excess land deficit can then be carried forward and deducted:

for 6 years of all your income

for 10 years from your land income alone.

If the revenues are lower than the charges, this creates a land deficit. This is then imputable to the total income of the taxpayer, under certain conditions and limits.

Charges other than loan interest can in fact be deducted from the declarant's other income up to a limit of € 10,700 per year.

The fraction of charges linked to loan interest can only be charged to property income. Loan interest is deductible from your property income only, so you cannot deduct it from your overall income.

When calculating the land deficit, you must first deduct loan interest from your property income, before then deducting other charges.

The main difference between empty rental and furnished rental is the furniture to be provided to the tenant for a furnished rental.

In bare rental (unfurnished), the law provides for only one type of lease, while in furnished, there are three contracts to choose from, depending on the profile of your tenant.

Furnished rentals: In France, the average gross return reaches 6% to 8% in non-seasonal furnished rentals (9 or 12 months).

Empty rental: the yield is within this range, between 4.5% to 6.5%.

Furnished rental is therefore generally more profitable than bare rental; rents are higher and the tax system more advantageous. However, tenant changes are more frequent and the risk of vacations higher.

Finally, depending on the type of rental chosen, the tax regime is different:

The rents derived from the empty rental constitute land income.

The rents derived from furnished rentals fall under the category of industrial and commercial profits (BIC).

In both cases there are two methods of taxation: fixed price or real.

In the micro-land regime, it is a question of declaring the rents excluding charges collected during the year, and of having a reduction of 30% on the declared sum. You will therefore be taxed on the remaining 70%:

Example: € 12,000 in rents excluding charges collected in 2020, the tax will relate to € 12,000 - 30% or € 8,400.

The 30% reduction is exclusive and cannot be deducted from others, whether for work or loan interest. Even if there is no charge on the property, you will still be able to benefit from the fixed reduction of 30% on the amount of annual rents collected.

Regarding the real estate regime, unlike micro-land, it allows certain charges to be deducted from annual rents.

The charges deductible from rents are subject to an exhaustive list. It's about :

Remuneration of guards and janitors

Remuneration of property managers and administrators:

insurance premiums:

Interest and borrowing costs.

Property taxes and ancillary taxes: this concerns in particular the property tax, including management costs (including those of the household waste collection tax), the contribution on rental income (CRL), the special equipment tax (TSE);

administration costs for a lump sum of 20 euros.

Rental charges not recovered.

Eviction and rehousing allowances.

Procedural costs.

The base of the gross capital gain of your residence is calculated by making the difference between the purchase price and the sale price.

You can deduct from the price, on supporting documents, the costs incurred during the sale (for example, the costs related to mandatory diagnostics).

The sale price must be increased by the sums paid for your benefit (for example, an eviction indemnity paid by the buyer to the tenant in place).

If the property has been purchased then it may be increased, upon proof, by the following costs:

Charges and indemnities paid to the seller upon purchase

Acquisition costs or deduction of a lump sum of 7.5% of the purchase price (registration fees, notary fees).

Work expenses (construction, reconstruction, extension, improvement under conditions).

For a property held for more than 5 years, you can deduct either the actual justified amount, or a flat rate of 15% of the purchase price

Road charges, networks and distributions (development costs for subdivision for example).

If the property is received by gift or inheritance, the purchase price of the residence will be that retained by the notary for when calculating inheritance or gift taxes.

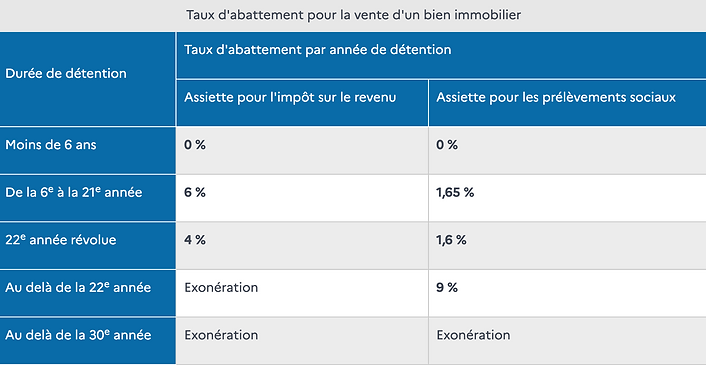

The taxable capital gain, also known as net capital gain, is obtained by applying deductions per year of ownership to the gross capital gain.

The principle is as follows: the longer you have held the property, the greater the deduction, the more the net capital gain decreases and therefore the more the amount of tax decreases.

The allowance for holding period differs depending on whether the taxable capital gain is determined for income tax (19%) or social security contributions (17.2%).

Under income tax, the allowance is:

6% for each year of ownership beyond the fifth and up to the twenty-first;

4% for the twenty-second completed year of detention.

The total exemption of real estate capital gains under income tax is thus acquired after a holding period of twenty-two years.

For social security contributions, the allowance is established as follows:

1.65% for each year of ownership beyond the fifth and up to the twenty-first;

1.60% for the twenty-second year of ownership;

9% for each year beyond the twenty-second.

Exemption from social security contributions is thus acquired at the end of a holding period of thirty years.

Note: In the event of a capital loss, that is to say a loss, it is not possible to deduct a capital gain realized on the sale of another property (with some exceptions).

Advantages & Disadvantages of bare rental

Naked Rental

Example of a bare rental investment

1

Initial situation

Samantha wishes to invest in rental property for € 250,000. The expected rent is estimated at € 630 per month. She has enough savings to make this purchase, but wonders if she should borrow

2

Cash payment

Rents received for 15 years = € 113,400 (€ 630 x 180 months)

Taxation generated by this income € 53,525 (marginal tax rate 30% + social security contributions 17.2%)

Net gain = € 59,875

3

Credit payment

Here, Samantha would bring 10% (€ 25,000) and invest the rest of her savings (€ 225,000) on a life insurance policy.

The return on the life insurance contract is estimated at 2.85% per annum net of management fees.

She borrows the sum at a rate of 1.40%.

Rents received over 15 years € 113,400 (€ 630 x 180 months)

Loan interest € 23,900

Taxation generated by this income € 42,245 (marginal tax rate 30% + social security contributions 17.2%)

Gain on the life insurance contract (net of tax and social security contributions) = € 88,875.

Net gain = 160,030 €