Que désirez-vous savoir ?

Pourquoi souscrire une assurance-décès ?

Le contrat d’assurance décès est un contrat de prévoyance qui permet le versement d'un capital ou d'une rente à un bénéficiaire désigné en cas de décès de l'assuré. Ce contrat peut être à durée déterminée (temporaire décès) ou indéterminée (contrat vie entière).

Le contrat d’assurance décès individuel est utile pour protéger sa famille en cas de difficultés financières liées à sa disparition.

La couverture décès peut être uniquement accidentelle ou bien toutes causes, c’est-à-dire en cas d'accident, mais aussi de maladie.

Le contrat d'assurance décès individuel peut prévoir le versement d'un capital ou bien d'une rente (rente d’éducation et/ou rente conjoint survivant).

Le contrat peut également proposer une garantie perte totale et irréversible d’autonomie (PTIA), ce qui permet à l’assuré de se prémunir contre le risque incapacité absolue et définitive de travailler.

Contrat de prévoyance : l'assurance-décès

Qu'est-ce qu'un contrat d'assurance-décès ?

L'assurance en cas de décès est un contrat d’assurance vie qui permet le versement d’un capital ou d’une rente à un bénéficiaire désigné, en cas de décès de l’assuré avant le terme du contrat.

Ces contrats d’assurance vie peuvent être souscrits individuellement ou collectivement, par l’intermédiaire d'une entreprise ou d’une association. Ils peuvent être souscrits à l’occasion d’un emprunt.

Les contrats d'assurance décès peuvent être souscrits soit pour une durée limitée (assurance temporaire décès), soit pour toute la vie (assurance vie entière).

La couverture décès peut être uniquement accidentelle ou bien toutes causes, c’est-à-dire en cas d'accident, mais aussi de maladie. Le contrat d'assurance décès individuel peut prévoir le versement d'un capital ou bien d'une rente (rente d’éducation et/ou rente conjoint survivant).

L’assurance en cas de décès peut être assortie de garanties complémentaires (garantie contre les risques d'incapacité ou d'invalidité, majoration de la garantie en cas de décès accidentel...).

Différentes formules permettent donc de constituer un capital ou une rente pour surmonter les difficultés financières qui peuvent survenir du fait de la disparition d'une personne.

Les contrats d'assurance décès peuvent être souscrits :

-

Soit pour une durée limitée (assurance temporaire) : ils permettent alors au survivant d'assurer le niveau de vie de la famille. L'assurance peut aussi assurer le paiement d'une rente destinée à financer les études des enfants.

-

Soit pour toute la vie (assurance "vie entière") : Le contrat d'assurance décès "vie entière" peut être souscrit sur 2 têtes, ce qui permet le versement à l'un des époux du capital ou de la rente au décès de son conjoint.

Ouverture du contrat

Ouverture du contrat

L’assurance décès prévoit, contre cotisations, le versement d’un capital aux bénéficiaires de votre choix en cas de décès.

Un acte de prévoyance indispensable pour protéger financièrement votre famille. À condition que les termes du contrat correspondent à vos besoins et à votre situation.

L’assurance décès vous permet donc laisser un capital à vos proches après votre décès (Enfants, conjoint, ami) afin qu’ils soient libres d’utiliser ce capital à leur convenance.

En cela, l’assurance décès se distingue d’une assurance obsèques, dont le capital doit obligatoirement être affecté au financement de vos frais d’obsèques.

Si vous souscrivez trop tard ce type d’assurance, vos cotisations seront importantes. Pour couvrir un capital intéressant et ne pas payer des primes trop importantes, il faut souscrire jeune et donc longtemps. D’ailleurs, la plupart des contrats ne peuvent être souscrits après un certain âge : 70 ans généralement.

Support de l’assurance-vie

Contrairement à une assurance vie, un contrat d’assurance décès n’est pas un placement financier.

Il est à fonds perdus et temporaire (souvent 10, 15, 20 ou 25 ans, selon l’âge de souscription).

En effet, si le risque ne se réalise pas - votre décès ou pour certains contrats, vôtre invalidité complète - avant un certain âge : 65 ans, 75 ans, parfois 80 ans – toutes vos cotisations seront perdues.

Pour éviter d'être à fonds perdus, il est possible d'opter pour une garantie décès "vie entière". En cas de décès du souscripteur (peu importe la date), les primes versées, augmentées des intérêts, seront récupérées par le bénéficiaire du contrat.

Disponibilités de l’épargne

En matière d’assurance vie, dont l’assurance décès en est une forme axée sur la prévoyance, il est parfois possible pour le souscripteur de récupérer le capital décès prévu par le biais d’un rachat. La récupération des fonds peut se faire pour une partie seulement, on parle alors de rachat partiel, ou pour l’intégralité des sommes prévues : rachat total.

L’assurance décès repose sur le principe que le souscripteur cotise pour qu’en cas de décès prématuré, ses bénéficiaires reçoivent un capital pour compenser les problèmes financiers liés au sinistre.

En conséquence, le rachat d’une assurance décès s’apparente à un retrait des fonds disponibles depuis le début de l’accord défini avec l’assureur.

Il convient de savoir à la souscription si le rachat de l’assurance décès est possible, sous peine de ne pas pouvoir récupérer le capital garanti avant son terme.

Quand le rachat est possible, le contrat contient un tableau de valeur de rachat, qui détermine les conditions du retrait. Parfois, ce dernier est gratuit à partir d’un certain nombre d’années de cotisation ou d’un certain montant.

Fiscalité de l’assurance décès

Lors du décès de l’assuré, les bénéficiaires désignés reçoivent un capital décès ou rente.

Ces sommes sont considérées comme une prestation versée par l’assureur, et non comme un héritage reçu sur le patrimoine du défunt.

Le capital décès ne fait donc pas partie de la succession. Et il n’est pas imposé à ce titre

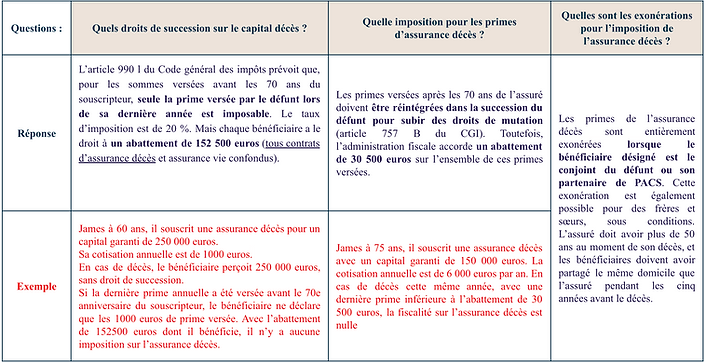

L’article 990 l du Code général des impôts prévoit que, pour les sommes versées avant les 70 ans du souscripteur, seule la prime versée par le défunt lors de sa dernière année est imposable. Le taux d’imposition est de 20 %. Mais chaque bénéficiaire a le droit à un abattement de 152 500 euros.

Les primes versées après les 70 ans de l’assuré doivent être réintégrées dans la succession du défunt pour subir des droits de mutation (article 757 B du CGI). Toutefois, l’administration fiscale accorde un abattement de 30 500 euros sur l’ensemble de ces primes. versées.

Garanties complémentaires

Il est possible de compléter son contrat d’assurance par d'autres garanties, qui ne sont pas toujours liées à la durée de la vie, mais couvrent un risque particulier, par exemple :

-

La garantie incapacité de travail : lors d'un arrêt de travail prolongé, une indemnité journalière est versée à l'assuré. Pendant cette période, l’assuré est éventuellement exonéré du paiement des cotisations relatives au contrat tout en bénéficiant du maintien des garanties.

-

La garantie invalidité : à la suite d'une invalidité définie dans le contrat, l'assureur verse des prestations sous la forme d'un capital ou d'une rente. Lorsque l’invalidité survient, l'assuré est exonéré du paiement des cotisations relatives au contrat d’assurance, tout en bénéficiant du maintien des garanties.

-

La garantie décès par accident : le capital versé au(x) bénéficiaire(s) peut être doublé ou triplé lorsque le décès survient par accident et notamment par accident de la circulation.

-

La garantie perte d'emploi Cette garantie est généralement proposée dans les contrats d’assurance liés à un prêt et prévoit soit le report des échéances du prêt, soit la prise en charge de la totalité ou d'une partie des mensualités pendant la durée fixée par le contrat.

Assurance temporaire décès et/ou assurance vie entière

-

Assurance temporaire décès : Elle garantit le versement d'un capital ou d'une rente en cas de décès de l'assuré survenant pendant la période de validité du contrat. Si l'assuré est en vie au terme de cette période, le contrat d’assurance prend fin. Les cotisations versées ne sont pas récupérées par le souscripteur du contrat, mais bénéficient à l'ensemble des assurés : il y a mutualisation des risques.

-

Assurance vie entière : Elle est souscrite pour une durée indéterminée et se dénoue lorsque survient le décès de l'assuré, quelle qu'en soit la date. Ce type de contrat d’assurance vie prévoit le versement d'un capital ou d'une rente au(x) bénéficiaire(s) désigné(s)

En matière d’assurance vie, dont l’assurance décès en est une forme axée sur la prévoyance, il est parfois possible pour le souscripteur de récupérer le capital décès prévu par le biais d’un rachat. La récupération des fonds peut se faire pour une partie seulement, on parle alors de rachat partiel, ou pour l’intégralité des sommes prévues : rachat total.

-

Le rachat partiel : dans ce cas précis, le souscripteur reprend une partie des fonds normalement prévus pour ses bénéficiaires en cas de décès prématuré. Le paiement du rachat se fait souvent par le biais de cotisations mensuelles, qui ne servent alors plus à constituer le capital, mais bien à avoir le droit de le récupérer. Il s’agit alors d’une solution qui doit être utilisée uniquement en cas d’urgence, surtout si plusieurs années ont passé depuis la souscription.

-

Le rachat total : ici, le retrait intégral des fonds est définitif et s’apparente à la résiliation (payante) du contrat puisque le souscripteur et ses bénéficiaires n’auront plus aucun capital auquel prétendre en cas de décès ou d’invalidité.

Si vous souhaitez racheter l’intégralité de votre capital décès, mais n’êtes pas contre souscrire de nouveau plus tard, il peut être utile de laisser une faible somme sur le compte. De cette manière, le contrat n’est pas clôturé et vous pouvez continuer à l’utiliser avec de nouvelles conditions.

Le montant de l'assurance décès ne fait pas partie, en soi, du patrimoine de l'assuré. La succession de l'assuré ne comprend que le patrimoine en sa possession à la veille de sa mort. Le capital de l'assurance décès échappe donc à tout prélèvement lié à la succession dans le sens où le montant de ce capital n'a jamais fait partie du patrimoine de l'assuré.

Toutefois :

-

Si les primes ont été versées avant le 70ème anniversaire de l’assuré ; la dernière prime est taxée au prélèvement libératoire de 20 % (ou 31,25% au-delà de 700 000 €) après un abattement de 152 500 € par bénéficiaire.

-

Le cumul des primes versées après le 70ème anniversaire de l’assuré, est réintégré dans l'actif successoral après un abattement de 30 500 € et taxé en fonction des liens de parenté entre le défunt et le bénéficiaire.

Avantages & Inconvénients de l'assurance-décès

Assurance-décès

Exemple d’utilisation du contrat d'assurance-décès pour des conjoints & les concubins

1

Situation initale

Victoria et Luc, âgés respectivement de 35 et 30 ans, se sont mariés en juin 2008, sans contrat de mariage.

De leur union sont issues 2 enfants, âgés de 5 et 8 ans.

Victoria ne travaille plus depuis 3 ans, Luc gagne correctement sa vie et ils préfèrent que ce soit elle qui s’occupent de leurs enfants. Sachant que le seul bien commun est leur résidence principale, ils se demandent ce qui arrivera si Luc venait à décéder.

2

Si rien n'est fait

Aux termes de l'article 757 du Code civil, en présence de descendants tous communs, le conjoint peut choisir lors de la succession un quart en pleine propriété ou l'usufruit de tous les biens du défunt.

Victoria devra assumer seule les charges d'éducation des deux enfants. Pour cela, elle devra trouver à nouveau un emploi pour lequel la rémunération ne sera pas forcément suffisante.

Le prédécès d'un jeune époux est souvent peu envisagé, pourtant les conséquences (notamment financières) sont, dans la plupart du temps, très lourdes.

3

Situation finale

Ces contrats d'assurance-décès sont des contrats de prévoyance dont les primes sont versées à fonds perdus.

Compte tenu de l’âge des époux et de leur état de santé, les primes versées seront modiques puisqu’elles sont calculées en fonction de la probabilité de réalisation du risque envisagé et du montant de l'indemnité versée en cas de décès.

Si le décès intervient durant l'exécution du contrat, la compagnie d'assurance s’engage à verser un capital au bénéficiaire désigné.

En l'espèce en sélectionnant un contrat d'assurance-décès, Luc et victoria optimisent la protection du survivant en lui attribuant un capital afin d'obtenir des ressources disponibles aisément. Ce capital permettra au conjoint de faire face aux charges de la vie courante comme l'éducation des enfants et le logement.

4

Assurance-décès et concubinage

Si Luc & Victoria avaient n’avait pas été marié, c’est-à-dire s’ils étaient concubin :

Le contrat d’assurance-décès aurait permis :

-

De contribuer à la protection du concubin survivant en lui attribuant un capital.

-

De permettre de s’acquitter de s’acquitter des droits de succession si le survivant est gratifié d’un legs, car il ferait l’objet d’une taxation très lourde sur les biens reçus (60 %).

-

Si les concubins souhaitent transmettre la pleine propriété de la résidence principale au survivant (et ainsi éviter l'indivision avec les héritiers réservataires), le contrat d'assurance décès peut apporter les fonds nécessaires au survivant pour acquérir la part indivise.