Que désirez-vous savoir ?

Pourquoi investir dans la location nue ?

Une habitation proposée en son état nu et dépourvu de mobilier, est dite en location vide ou nue ou encore non meublée. Le contrat de location non meublée est géré par les termes de la loi du 6 juillet 1989.

Cette dernière a subi quelques modifications apportées par la loi Alur du 24 mars 2014 et par la loi pour la croissance du 6 août 2015.

Le propriétaire et le locataire sont tous les deux soumis aux dispositions de cette loi

Une location nue est donc un bien immobilier qui est loué sans aucun meuble ni équipement autre que les équipements nécessaires.

Les seuls équipements fournis dans une location nue sont des sanitaires, une salle de bains et des éléments de cuisine (un évier par exemple). Le terme de location nue s’oppose à celui de location meublée.

Cet investissement peut être optimisé grâce à un dispositif fiscal,

-

Type Pinel pour un logement neuf ou Cosse pour un bien dans l’ancien.

En location vide, vous déclarez vos loyers dans la catégorie des revenus fonciers. Selon les cas, vous relèverez du micro-foncier ou du régime réel. Avec le premier, vous êtes imposé sur 70 % de vos loyers. Le second vous permet de créer des déficits fonciers qui viennent diminuer vos impôts.

La location nue, une location avec de nombreux atouts

Qu'est-ce que l'immobilier locatif nu ?

La location nue, par définition, s’oppose à la location meublée. Ce type d’investissement s’oriente vers le locatif vide, sans meuble. Ces biens immobiliers attirent les investisseurs : ils constituent un placement avec une rentabilité très intéressante et une fiscalité avantageuse.

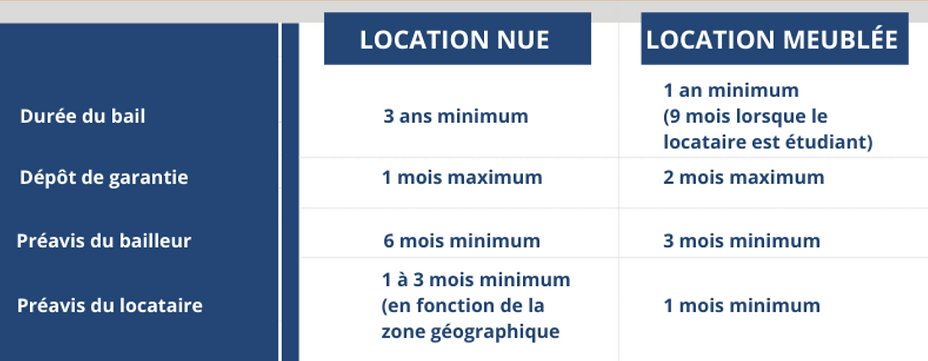

Le bail d’un logement nu, pour un appartement ou une maison, est établi selon la loi du 6 juillet 1989.

Ce dernier doit :

-

être rédigé, signé et daté par le propriétaire et le locataire ;

-

durer 3 ans minimum (renouvelable par tacite reconduction) – 6 ans minimum pour un bailleur personne morale -

-

Il est toutefois possible de conclure un bail dit de courte durée d’un an minimum pour des raisons familiales ou professionnelles (cf Article 11 de la Loi du 6 Juillet 1989).

-

Le bien doit être complètement vide de tout meuble.

Les revenus tirés de cette location seront à déclarer dans la catégorie des revenus fonciers.

On notera que le régime dit du micro-foncier est plus simple. En revanche, il n’est intéressant que dans la mesure où les charges que vous pourriez déduire sont d’un montant inférieur à la valeur de l’abattement forfaitaire de 30 %.

Attention : Le micro-foncier n’est pas possible si vous investissez en profitant des avantages de certaines niches fiscales (dispositifs Besson, Robien…). Il n’est également pas possible non plus si les loyers ne sont pas encaissés par vous directement, mais par une société, comme une SCI par exemple.

À noter : Cet investissement peut être optimisé grâce à un dispositif fiscal, type Pinel pour un logement neuf ou Cosse pour un bien dans l’ancien. Il faudra alors vérifier que toutes les conditions du dispositif choisi sont respectées pour bénéficier de l’avantage fiscal.

Détenir de l'immobilier locatif nu

Vous pouvez détenir le bien :

-

en direct (en nom propre), c’est-à-dire sans structure intermédiaire, il fait partie de votre patrimoine,

-

ou par le biais d’une SCI, autrement dit vous êtes associé de la société qui se porte acquéreur du bien immobilier.

La Société Civile Immobilière (SCI) est souvent utilisée dans le cadre d’investissements immobiliers locatifs familiaux, car elle permet de détenir le bien à plusieurs sans les soucis de l’indivision !

De plus, elle permet d’optimiser la transmission du patrimoine aux enfants tout en conservant le contrôle.

Financement de l’acquisition

Acquisition au comptant :

L'acquisition immobilière d'un bien locatif grâce à un apport personnel permet d'obtenir immédiatement des revenus réguliers.

Si l'investisseur veut percevoir des revenus différés dans le temps, il peut opter pour l'acquisition de la nue-propriété d'un bien locatif. Dans ce cas, l'usufruit s'éteindra au jour où l'investisseur souhaite entrer en jouissance des revenus locatifs.

Paiement à crédit :

Le terme du prêt coïncidera avec la date souhaitée de perception des revenus (différés dans le temps) et les intérêts d’emprunt réduiront les revenus fonciers imposables.

Si l’acquisition est financée à l’aide d’un prêt immobilier, il convient de consulter un établissement de crédit ou un courtier pour obtenir un financement adapté à la situation de l’emprunteur.

Le prêt peut être :

-

amortissable ; remboursement du capital emprunté au fil de l'eau

-

ou in fine ; remboursement du capital emprunté en une seule fois au terme du crédit.

-

Toutefois, le prêt in fine nécessite un apport qui sera placé sur un contrat afin de garantir le remboursement à terme (=adossement).

-

Détention en direct (nom propre)

Avantages de la détention de l'immobilier en direct :

-

Simplicité d’acquisition,

-

Imposition à l’IR peu importe la nature de l’activité,

-

La plus-value est soumise au régime plus-values immobilières des particuliers.

Inconvénients de la détention de l'immobilier en direct:

-

Peu de solutions d’optimisations juridiques et fiscales,

-

Si plusieurs acquéreurs (indivision) : nécessité de l’accord de tous.

Baux et garanties location nue

Le bien loué nu peut être un logement, mais aussi un bureau, une boutique, etc.Le bail de location dépend de l’usage que le locataire fait du bien.

-

Locataire à un usage de résidence principale : Bail d’habitation (Loi du 6 juillet 1989)

-

En location vide, la durée du bail est de trois ans. Mais il n'est pas exclu de conclure un bail plus long, de quatre ans par exemple, même si ce n'est pas d'usage. Lorsque le bail arrive au terme des trois ans, il se renouvelle par tacite reconduction pour la même durée, sans avoir besoin d'en signer un nouveau.

-

-

Locataire a un usage professionnel : Bail professionnel

-

Si le propriétaire est une personne morale (une société), le bail est conclu obligatoirement pour six années, sauf si vous possédez le bien via une SCI familiale (constituée entre parents et alliés jusqu'au quatrième degré inclus), auquel cas le bail est de trois ans.

-

-

Locataire a un usage commercial : Bail commercial

-

Le contrat de bail est conclu pour 9 ans au minimum. Le bailleur et le locataire peuvent décider de conclure un contrat d'une durée plus longue. Mais le contrat ne peut pas être conclu pour une durée indéterminée. Le bailleur doit payer une indemnité d'éviction au locataire en cas de résiliation du bail commercial.

-

Vous avez la possibilité de conclure un contrat d'une durée inférieure à trois ans et d'au moins une année si vous avez un motif familial ou professionnel qui le justifie.

Ce motif est à préciser dans le bail ainsi que l’événement qui mettra fin au bail (départ à la retraite, retour d’un enfant de l’étranger...).

Enfin, plusieurs dispositifs permettent de garantir le paiement du loyer :

-

La caution :En cas de défaut de paiement du locataire ou de dégradations, le bailleur peut se retourner vers la caution :

-

simple(elle ne pourra intervenir qu’après avoir relancé plusieurs fois le locataire) ou solidaire (sollicitée dès le premier impayé)

-

-

La garantie des loyers impayés : assurance privée que le bailleur peut souscrire auprès d’une banque ou d’une compagnie d’assurance. Elle couvre aussi bien les loyers impayés que les dégradations, mais elle n’est pas gratuite (la cotisation coûte entre 2,5 % et 5 % du loyer annuel).

-

La garantie Visale : C’est l’organisme "Action logement" qui se porte garant et c’est gratuit. Elle couvre toute la durée du bail dans la limite de 36 mois d’impayés. Elle peut notamment être utilisée lorsque le locataire a peu ou pas de revenus ou s’il est dans une situation précaire.

-

Le fonds de solidarité logement : Cette garantie couvre les personnes en difficulté et donc non assurables.

Détention en SCI

Avantages de la détention de l'immobilier via une SCI :

-

Aménagement statuts (nomination et révocation du gérant, règles quorum et majorité, clause agrément),

-

Transmission progressive avec conservation du pouvoir,

-

Modifier la gestion des biens entre les époux,

-

Éviter l’indivision,

-

Éviter la présomption de propriété.

Inconvénients de la détention de l'immobilier via une SCI :

-

Coût de gestion,

-

Tenue d’une comptabilité,

-

Responsabilité indéfinie et conjointe des associés,

-

La location meublée entraîne l’imposition à l’IS.

Fiscalité

Lorsque vous louez un logement vide de meubles, les revenus sont à indiquer dans la catégorie des "revenus fonciers" de votre déclaration de revenus (n°2042).

Deux régimes d'imposition existent pour les revenus fonciers : le régime micro foncier ou le régime réel.

Micro foncier : La déclaration des revenus fonciers sous le régime micro-foncier est réservée aux ménages investisseurs qui touchent moins de 15 000 € par an de loyers bruts.

Il prévoit un abattement forfaitaire de 30 % sur le total des loyers bruts perçus pour prendre en compte tous les frais liés à ces investissements locatif.

Le régime micro foncier ne s'applique pas dans certaines situations (monuments historiques, logement bénéficiant d'un régime de déduction particulier).

Le régime réel peut être choisi quel que soit le montant des loyers perçus, et devient obligatoire au-delà de 15 000 € par an. Son principal avantage est qu'il prend en compte l'intégralité des charges déductibles des revenus fonciers avant imposition.

Les charges pouvant être déduites de vos revenus fonciers sont nombreuses. Elles incluent :

-

les dépenses de travaux, de rénovation et de réparation

-

la réalisation de diagnostics immobiliers

-

les intérêts de l'emprunt et l'assurance emprunteur

-

l'assurance du bien, ainsi que l'assurance des loyers impayés

-

les charges de copropriété, à l'exception des charges locatives récupérables

-

la taxe foncière

Si l'intégralité de ces charges dépasse 30 % du montant des loyers, vous avez intérêt à passer au régime réel. Dans certains cas, des charges très importantes peuvent même vous permettre de générer un déficit imputable sur les revenus fonciers, mais aussi sur l'intégralité des revenus du contribuable.

À noter : Les travaux de construction, reconstruction ou d’agrandissement ne peuvent en revanche pas être déduits de votre revenu foncier.

Si l'investissement dans l'immobilier classique (non meublé) ne permet pas d'amortir la partie immobilière (contrairement au LMNP par exemple), certains travaux sont 100% déductibles et imputables dans la limite de 10700 € par an.

Chaque année, vous pouvez déduire de vos revenus jusqu’à 10 700 € de déficit foncier (ou 15 300 € dans certains cas particuliers).

Toutefois, l’excèdent de déficit foncier peut ensuite être reporté et déduit :

-

durant 6 ans de l’ensemble de vos revenus

-

durant 10 ans de vos seuls revenus fonciers.

Si les recettes sont inférieures aux charges, cela crée un déficit foncier. Celui-ci est alors imputable sur le revenu global du contribuable, dans certaines conditions et limites.

-

Les charges autres que les intérêts d'emprunt peuvent être en effet déduites des autres revenus du déclarant dans la limite de 10 700 € par an.

-

La fraction de charges liée aux intérêts d'emprunt ne peut, quant à elle, être imputée que sur les revenus fonciers. Les intérêts d’emprunt sont déductibles de votre seul revenu foncier.Vous ne pouvez donc pas les déduire de votre revenu global.

-

Lors du calcul du déficit foncier, vous devez déduire en priorité les intérêts d'emprunt de votre revenu foncier, avant de déduire ensuite les autres charges

-

La principale différence entre location vide et location meublée est le mobilier à fournir au locataire pour un meublé.

En location nue (non meublée), la loi ne prévoit qu'un seul type de bail, alors qu'en meublé, il y a trois contrats au choix, selon le profil de votre locataire.

Location meublée : En France le rendement moyen brut atteint 6 % à 8 % en location meublée non saisonnière (9 ou 12 mois).

Location vide : le rendement se situe dans ce cadre, entre 4,5 % à 6,5 %.

La location meublée est donc généralement plus rentable que la location nue ; les loyers sont plus importants et le régime fiscal plus avantageux. Toutefois, les changements de locataires sont plus fréquents et le risque de vacances plus élevé.

Enfin selon le type de location choisi, le régime fiscal est différent :

-

Les loyers tirés de la location vide constituent des revenus fonciers.

-

Les loyers tirés de la location meublée rentrent dans la catégorie des bénéfices industriels et commerciaux (BIC).

Dans les deux cas il existe deux modes d'imposition : au forfait ou au réel.

Dans le régime du micro foncier, il s’agit de déclarer les loyers hors charges encaissés dans l’année, et d’avoir un abattement de 30 % sur la somme déclarée. Vous serez donc imposé sur les 70 % restants :

Exemple : 12 000 € de loyers hors charges encaissés en 2020, l’imposition portera sur 12 000 € - 30 % soit 8 400 €.

L’abattement de 30 % est exclusif et que l’on ne peut rien déduire d’autres, qu’il s’agisse de travaux ou intérêts d’emprunt. Même si aucune charge ne pèse sur le bien, vous pourrez malgré tout bénéficier de l’abattement forfaitaire de 30 % sur le montant des loyers annuels encaissés.

Concernant le régime du réel, contrairement au micro-foncier, il permet de déduire des loyers annuels certaines charges.

Les charges déductibles des loyers font l’objet d’une liste limitative. Il s’agit :

-

De la rémunération des gardiens et concierges

-

Des rémunérations des gérants et administrateurs immobiliers :

-

des primes d’assurance :

-

Des intérêts et frais d’emprunt.

-

Des taxes foncières et taxes annexes : il s’agit notamment de la taxe foncière, y compris les frais de gestion (dont ceux de la taxe d’enlèvement des ordures ménagères), de la contribution sur les revenus locatifs (CRL), de la taxe spéciale d’équipement (TSE) ;

-

des frais d’administration pour un montant forfaitaire de 20 euros.

-

Des charges locatives non récupérées.

-

Des indemnités d’éviction et de relogement.

-

Des frais de procédure.

L’assiette de la plus-value brute de votre résidence se calcule en faisant la différence entre le prix d’acquisition et le prix de vente.

-

Vous pouvez déduire du prix, sur justificatifs, les frais supportés lors de la vente (par exemple, les frais liés aux diagnostics obligatoires).

-

Le prix de vente doit être augmenté des sommes versées à votre profit (par exemple, une indemnité d’éviction versée par l’acheteur au locataire en place).

Si le bien a été acheté alors il peut être augmenté, sur justificatifs, des frais suivants :

-

Charges et indemnités versées au vendeur à l’achat

-

Frais d’acquisition ou déduction d’un montant forfaitaire de 7,5 % du prix d’achat (droits d’enregistrement, frais de notaire).

-

Dépenses de travaux (construction, reconstruction, agrandissement, amélioration sous conditions).

-

Pour un bien détenu depuis plus de 5 ans, vous pouvez déduire soit le montant réel justifié, soit un forfait de 15 % du prix d’achat

-

-

Frais de voirie, réseaux et distributions (frais d’aménagement pour lotissement par exemple).

Si le bien est reçu par donation ou succession, le prix d’acquisition de la résidence sera celui retenu par le notaire pour lors du calcul des droits de succession ou de donation

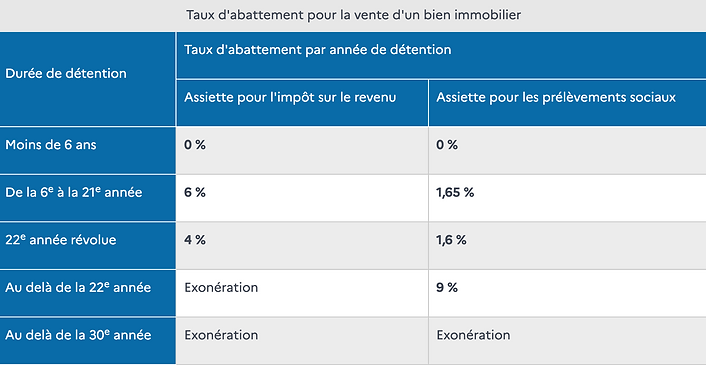

La plus-value imposable, on parle aussi de plus-value nette, s’obtient en appliquant à la plus-value brute des abattements par année de détention.

Le principe est le suivant : plus vous détenez le bien depuis longtemps, plus l’abattement est important, plus la plus-value nette diminue et par conséquent plus le montant d’impôt baisse.

L’abattement pour durée de détention diffèrent selon que l’on détermine la plus-value imposable au titre de l'impôt sur le revenu (19 %) ou des prélèvements sociaux (17,2 %).

Au titre de l’impôt sur le revenu, l’abattement est de :

-

6 % pour chaque année de détention au-delà de la cinquième et jusqu’à la vingt-et-unième ;

-

4 % pour la vingt-deuxième année révolue de détention.

L’exonération totale des plus-values immobilières au titre de l’impôt sur le revenu est ainsi acquise à l’issue d’un délai de détention de vingt-deux ans.

Au titre des prélèvements sociaux, l’abattement s’établit comme suit :

-

1,65 % pour chaque année de détention au-delà de la cinquième et jusqu’à la vingt-et-unième ;

-

1,60 % pour la vingt-deuxième année de détention ;

-

9 % pour chaque année au-delà de la vingt-deuxième.

L’exonération des prélèvements sociaux est ainsi acquise à l’issue d’un délai de détention de trente ans.

À noter : Lors d’une moins-value, c’est-à-dire une perte, il n’est pas possible de déduire d’une plus-value réalisée lors de la vente d’un autre bien (sauf exceptions).

Avantages & Inconvénients de la location nue

Location Nue

Exemple d’investissement en location nue

1

Situation initale

Samantha souhaite investir en immobilier locatif pour 250 000 €. Le loyer attendu est estimé à 630 € par mois. Elle dispose d’une épargne suffisante pour réaliser cet achat, mais se demande si elle doit recourir à un emprunt

2

Paiement comptant

Loyers perçus pendant 15 ans = 113 400€ (630 € x 180 mois)

Fiscalité générée par ces revenus 53 525 € (taux marginal d’imposition 30 % + prélèvements sociaux 17,2 %)

Gain net= 59 875 €

3

Paiement à crédit

Ici, Samantha apporterait 10 % (25 000 €) et place le reste de son épargne (225 000 €) sur un contrat d'assurance vie.

Le rendement du contrat d'assurance vie est estimé à 2,85 % par an net de frais de gestion.

Elle emprunte la somme à un taux de 1,40 %.

Loyers perçus pendant 15 ans 113 400€ (630 € x 180 mois)

Intérêts d’emprunt 23 900 €

Fiscalité générée par ces revenus 42 245 € (taux marginal d’imposition 30 % + prélèvements sociaux 17,2 %)

Gain sur le contrat d’assurance-vie (net de fiscalité et de prélèvements sociaux) = 88 875 €.

Gain net= 160 030 €